Student Loan Forgiveness Is Ruled Out: How Employers Can Respond

Author: Natasha K.A. Wiebusch

August 22, 2023

Biden’s student loan forgiveness plan was set to cancel up to $20,000 in qualified student loans per borrower, eliminating all student loans for almost half of Americans. But as of June 30, 2023, cancellation is no longer on the table, and employees with student loan debt will have to start repaying their loans as soon as October.

Student loans are nothing new to Americans. However, tuition costs, the cost of living and inflation have all snowballed, transforming what was once just a monthly payment into a life altering burden. The resulting financial stress is damaging not only employee health and well-being, but also workplace productivity, engagement and retention.

With student loan forgiveness ruled out, employees are now calling on employers to help. Through strategic benefits designed to improve financial wellness, employers can answer.

Who Has Debt?

According to the Education Data Initiative (EDI), borrowers owe an average of $37,338 in student loan debt. Data shows that this amount varies significantly based on:

- Education level achieved. Borrowers with a master’s degree owe an average of $80,494. Law graduates owe over $180,000 and medical school graduates owe more than $200,000.

- Race and Ethnicity. Black college graduates owe about $7,400 more than their white peers upon graduation, and the gap triples after a few years, according to the research by the Brookings Institution.

- Sex or Gender. On average, women consistently hold more student debt than their male counterparts across all races, according to a 2022 Momentive survey.

- Intersectionality. The EDI found that black women have the highest level of student loan debt upon graduation compared to their white, Hispanic, Asian and counterparts, and men.

Measuring the Impact

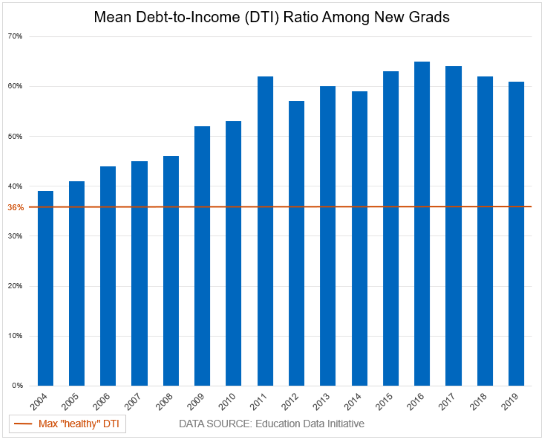

Over the last few decades, student loan debt has become a heavier weight for borrowers to carry. Not only has the overall average nearly tripled since the 1980s, but graduates with debt also continue to experience worse financial health.

According to data compiled by the EDI, student debt alone has increased new graduates’ debt-to-income (DTI) ratio beyond 36% since at least 2004. The Consumer Financial Protection Bureau (CFPB) considers a DTI above 36% to be unhealthy.

Today, the weight of student loan debt has impacted employees’ ability to:

- Become homeowners;

- Save for retirement;

- Start or grow their family;

- Continue their education; and

- More.

For many, the impact of repayment may be even worse. Last month, more than half of federal student loan borrowers disclosed they would be forced to choose between making their student loan payments or paying for necessities, like rent, bills, and groceries.

How Employers Can Help

When repayment requirements for federal student loans start in October, many employees will feel the weight of their student loans for the first time, as these requirements have been paused since March 2020. Below are five strategic benefits that can help.

1. Educational Assistance Benefits

Educational assistance benefits are reimbursements for tuition and other necessary educational expenses. Employers may offer up to $5,250 in educational assistance benefits on a pre-tax basis if they operate a qualified educational assistance program. Through 2025, employers can also make payments to an employee’s student loans on a pre-tax basis up to $5,250.

With an average monthly student loan payment of $503 (10% of a $60,360 salary), employers can either significantly reduce or eliminate this monthly cost for employees with pre-tax student loan repayment benefits.

Employers should also take note that average monthly payments may decrease as a result of the new federal student loan repayment program, the Saving on a Valuable Education (SAVE) Plan, which launched on August 22, 2023.

2. Personalized Employee Development

In addition to reimbursements, employers can offer personalized development programs. These programs upskill employees, support the organization’s talent strategy, promote internal succession, and improve key HR performance indicators. Most importantly, through development programs, employers can provide employees with the opportunity to grow without taking on new student loan debts.

For employee development programs to succeed, employers must consider individual employee interests and career goals, the organization’s business strategy, among other strategic factors.

Did you know?

Waste Management launched a multi-faceted education benefits program for its employees and their dependents in 2021. Two years in, the company has discovered that employees who enrolled are: .

- 60% less likely to leave;

- 88% less likely to leave if they have a dependent enrolled; and

- 3.3 times more likely to receive a promotion.

3. Student Loan Retirement Matches

Many employees will stop contributing to their retirement plans to keep up with student loan payments. To help employees continue to save for retirement, employers can make retirement contributions for employees, even when they can’t. That is, when an employee makes a qualified student loan payment, an employer can make a matching contribution to the employee’s defined contribution retirement account.

Though similar arrangements currently exist, the much awaited SECURE 2.0 Act greatly reduces the regulatory burdens involved. Under the Act, starting in 2024, an employer may treat an employee’s qualified student loan repayment as an elective deferral or after-tax contribution.

Questions about this new contribution arrangement remain, including which types of student loans will qualify. The International Revenue Service is expected to issue regulations to answer this and other questions by the end of the year.

4. Personalized Financial Wellness Programming

The 2023 HR & Compliance Center Retirement Benefits Survey Report found that 65% of employers offer financial wellness programming and 56% make efforts to connect employees with a broker for financial advice. And yet, according to research by the Employee Benefit Research Institute, the top three sources of retirement information do not include employer programming. They include:

- Online resources and research employees do on their own;

- Family and friends; and

- A personal, professional financial advisor.

Employers ranked fourth, and representatives from a workplace retirement plan ranked fifth. Unsurprisingly, a survey by Morgan Stanley at Work found that most employers report less than 50% participation in financial wellness benefits. The top reasons for this low participation centered around communication. Indeed, according to the HR & Compliance Center retirement survey report, a third of organizations rarely or never send communications related to retirement.

To help employees manage their student loan payments, employers must offer and communicate financial wellness programming relevant to individual employee needs. For example, if employees are feeling stressed about making rent or paying for other necessities, communications about long-term retirement advice won’t garner any attention, much less engagement.

Employers that would like design their financial wellness programs and communications to assist employees with student loan debt should consider:

- Employee voice;

- Employee income;

- Cost of living;

- Debt amount;

- Employee demographics and intersectionality; and

- Immediate needs.

5. Reducing Other Costs

More than half of federal student loan borrowers may need to choose between making their student loan payments or paying for necessities. And according to a report by the CFPB, one in five borrowers have at least one risk factor that suggests they could struggle when scheduled payments resume.

Employers can help by offering benefits that specifically reduce costs of living. The following are examples employee benefits designed to reduce such costs:

Benefits that Reduce Other Costs:

- Dependent care benefits (on-site childcare, DCFSA, etc.);

- Employer discounts (gym, food, cell phone service, etc.);

- Employer provided food and meals;

- Home office stipends;

- Flexible work (including hybrid/remote work);

- Health care benefits;

- Housing and relocation funds for new hire;

- Paid leave (i.e., paid parental leave and sick leave) and PTO ;

- Pet insurance;

- Transportation benefits; and

- Wellness benefits.

Beyond Benefits

In addition to offering benefits to help employees manage their student loans, employers must remain vigilant of signs of financial distress, worsening physical and mental health, and disengagement. Most importantly, employers should make sure employees know they’re not alone by communicating often and intentionally with employees about their options.