IRS Allows Employers to Withdraw Forms 941-X With Erroneous ERC Claims

Author: Rena Pirsos, Brightmine Legal Editor

October 19, 2023

The Internal Revenue Service (IRS) has opened a new program through which employers that mistakenly claimed the Employee Retention Credit (ERC) on Form 941-X can withdraw their claims without incurring penalties or interest. However, this relief is not available to employers that fraudulently claimed the ERC on Form 941-X. But employers that cannot withdraw their Forms 941-X can also obtain penalty relief.

Background

The ERC was a pandemic-era payroll tax credit that eligible employers could claim on Form 941 to offset the salary and/or health benefits they continued to provide to employees who could not otherwise continue to work.

The ERC expired for most employers on September 30, 2021. So-called ERC mills then began aggressively marketing their skill at helping employers to claim the ERC on Form 941-X, regardless of whether they were eligible for it. As a result, many unsuspecting, ineligible employers were scammed into filing Forms 941-X to claim the ERC.

So many of these Forms 941-X were filed that the IRS was forced to take the extraordinary step of placing a moratorium on processing them. The moratorium took effect on September 14, 2023, and will last through at least the end of this year.

Program Details

Only Forms 941-X filed to claim the ERC no later than September 14, 2023, and on which no other adjustments have been made, may be withdrawn. Employers must intend to withdraw their entire ERC; this may need to be done on a quarter-by-quarter basis.

The IRS has set up a special fax line — 855-738-7609 — to receive withdrawal requests. Employers that cannot fax their withdrawal requests should mail their forms to the address indicated in the instructions to Form 941-X. The IRS warns, however, that it will take more time to process requests that are mailed.

An employer that used a third-party payroll provider to file Form 941-X should consult with the provider.

How to Make a Withdrawal Request

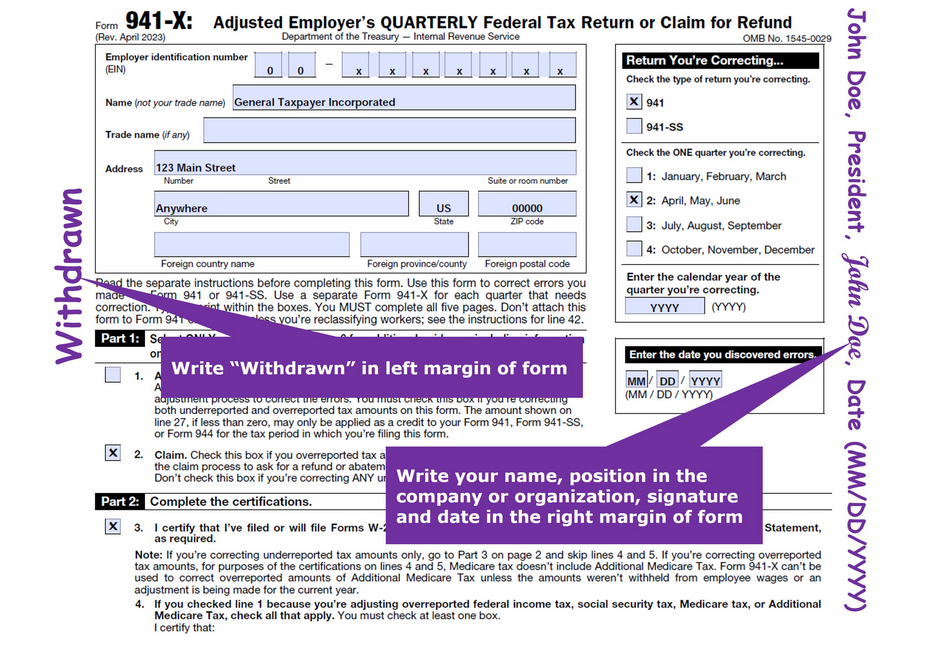

Employers that have not received a refund and have not been notified that their claim is under audit should make a copy of each quarterly Form 941-X on which the ERC is claimed and then mark up each form as follows:

An employer that has been notified that the IRS is auditing their claim may withdraw their Form 941-X by completing it as shown above. The form should not be faxed to the IRS. Instead, the employer should communicate directly with their IRS examiner if an examiner has already been assigned. If an examiner has not been assigned, they should respond to the audit notice with their withdrawal request, following the instructions in the notice for responding.

An employer that received a refund check but has not cashed or deposited it should complete their Form 941-X as shown above. They should write “Void” in the endorsement section on the back of the refund check; include a note entitled “ERC Withdrawal” to briefly explain the reason for returning the refund check; and copy the front and back of the check and their explanatory note. These materials should be mailed to the IRS at:

Cincinnati Refund Inquiry Unit

PO Box 145500

Mail Stop 536G

Cincinnati, OH 45250

The IRS specifies that the voided check or the explanatory note should not be stapled or paper-clipped. It also suggests that employers track their packages to confirm delivery at the IRS.

The IRS will notify employers whether their withdrawal has been accepted. If the IRS approves a withdrawal, the employer may have to file Form 1120-X to adjust their salary and health benefit deductions.

Help for Employers That Cannot Withdraw Their Forms 941-X

Employers that cannot withdraw their Form 941-X (e.g., they claimed the credit on Form 941, not Form 941-X) can still receive tax relief by preparing a new Form 941-X with the correct amount of ERC and any other corrections for that calendar quarter.

These forms should be mailed to the address indicated in the Form 941-X instructions.